The Life Cycleof a Stock: From IPOto Market Movements How Shares Gain & Lose Value

Key Takeaways

Understanding the Life Cycle of a Stock

Let's delve deeper into the fascinating journey of a stock's price formation and evolution over time by closely examining the trajectory of GreenTech's stock, from its inception to maturity.

Picture this: when GreenTech shares first hit the market at $10, savvy investors begin purchasing them, anticipating the company's growth. During this early stage, the price remains low and stable.

As GreenTech keeps pushing boundaries with its innovative products, more investors are drawn to its promising trajectory, driving up the demand for its shares. This surge catapults the price of your $10 shares to an impressive $20, showcasing a remarkable increase in market confidence and investor enthusiasm

In the excitement of escalating stock prices, it's important to be careful and thoughtful. Even though a higher price might suggest people are optimistic about GreenTech's future, it's essential to check if the price matches what the company is really worth. Sometimes, hype can drive prices up too high, leading to a market correction later on.

Now, here's the truth about rising stock prices: while they can indicate market confidence, they don't always directly reflect the company's success. Various factors, such as market trends and investor sentiments, influence prices.

As the GreenTech stock price keeps going up, investors are now at a crossroads - should they cash in on their profits by selling their shares, or should they wait and hope for the price to go even higher? Making this decision is tricky and requires a good grasp of how the market works and how well GreenTech is doing. It really emphasises the need to keep a close eye on the market

If selling activity outweighs buying, GreenTech's stock price may decline. However, a lower price doesn't necessarily spell trouble. It could present an opportunity to acquire more shares, especially if the company's future prospects remain promising

Following a period of price correction or consolidation, GreenTech might experience a new wave of market action. This could mean more people becoming interested in buying at lower prices, or it could mark the beginning of a new phase in the market due to changing conditions. This back-and-forth pattern illustrates how market forces and stock prices interact and evolve over time.

So, according to GreenTech, stock prices can be influenced by different factors. Let's see if stock prices are related to a company's size or show a decrease in growth.

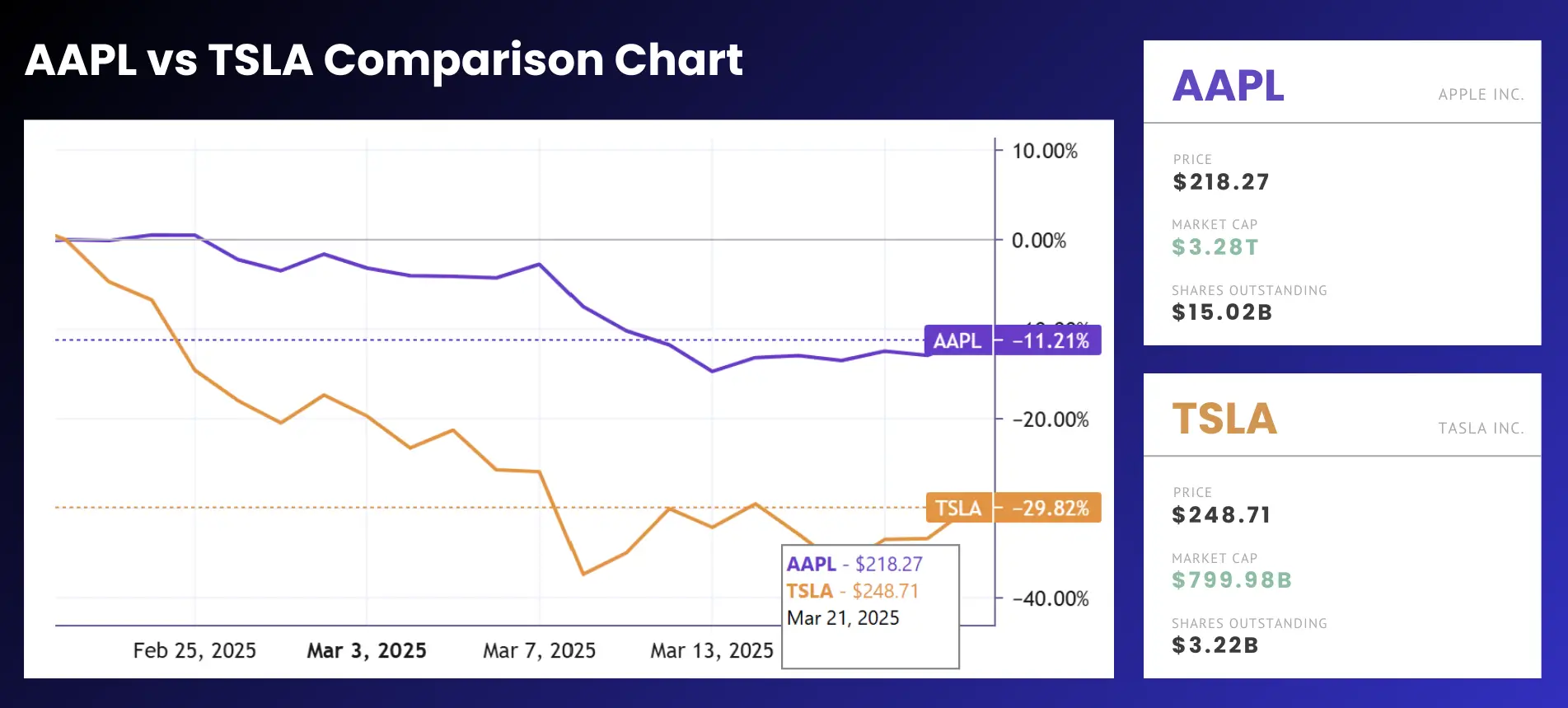

Let's talk about how Tesla and Apple's stock prices compare. Tesla's stock price is above $248, while Apple's is around $218. But we shouldn't just focus on these numbers - we need to look deeper to understand why there's a difference.

When we look at their revenues, Apple is clearly ahead with nearly $3.28 trillion, much more than Tesla's $799.98 billion. Despite this huge gap, Tesla's stock price is still higher than Apple's.

The reason for this seeming discrepancy lies in how many shares each company has issued. Apple has a lot more shares out there, about 15.02 billion, compared to Tesla's 3.22 billion.

This means Apple's stock price is lower because there are more shares in circulation, which reduces the value of each share. On the other hand, Tesla's stock price is higher because it has fewer shares available, showing how the number of shares affects the stock price.

A stock's journey involves various stages shaped by many factors both from within and outside the company. Although increasing stock prices can reflect positive market sentiment, they may not always reflect the company's true value. To make wise investment decisions in the stock market, it's important for investors to grasp how market fluctuations, company performance, and share issuance interact with each other.