Market Cycles & Economic Indicators: Predicting TrendsBoom or Bust? Understanding Stock Market Cycles

Key Takeaways

Hey there! Today, we're diving deep into how market cycles and important economic indicators are connected. Knowing these ideas well is crucial for grasping how markets work and for making smart investment choices.

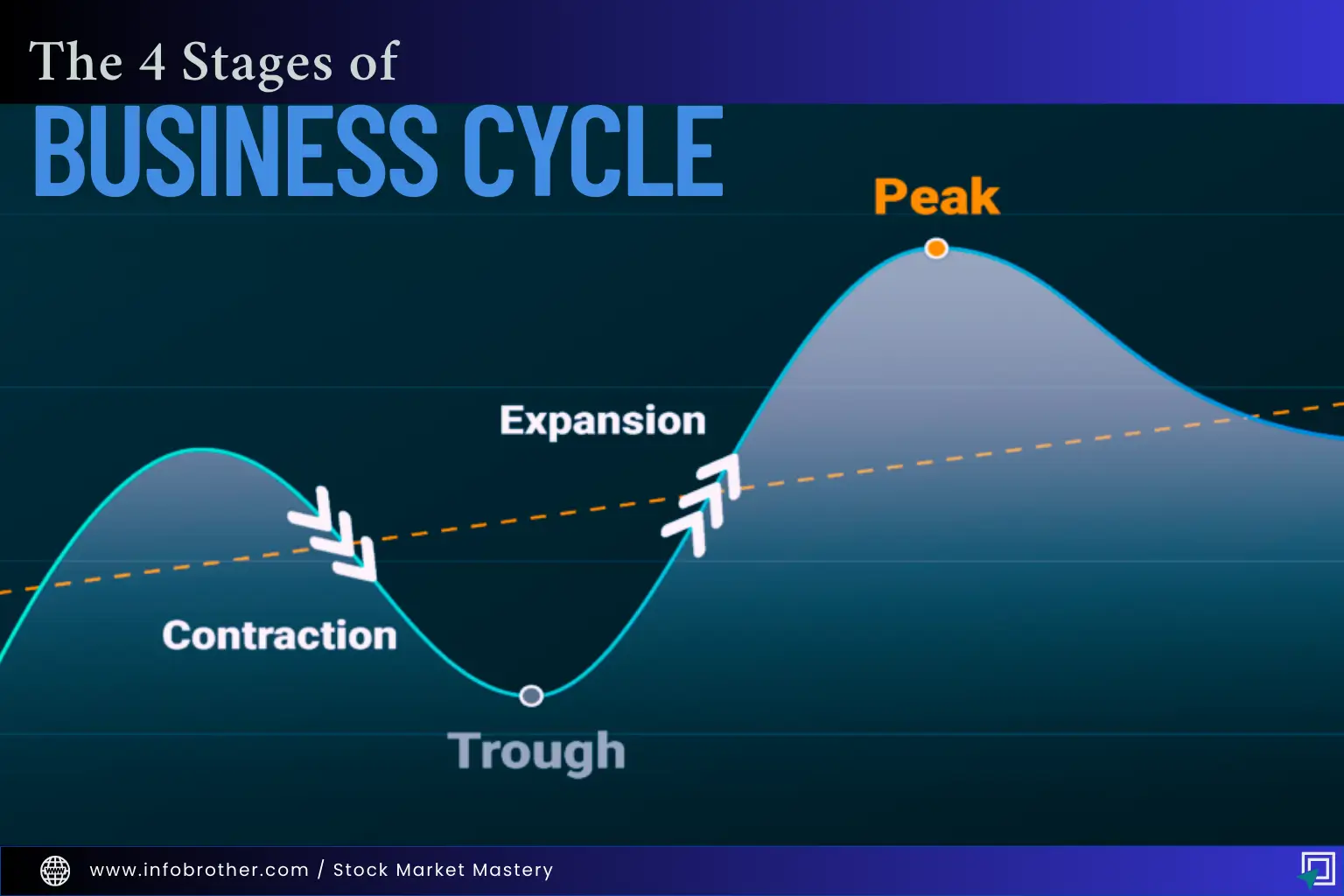

Market cycles are like recurring patterns in the financial world. They go through stages of growth, peak, decline, and recovery, just like the ups and downs of the economy. It's kind of like the heartbeat of the economy, showing how economic activity changes over time. Each phase of the market cycle has its own unique traits and obstacles, much like the different seasons.

Think of Market cyclesas being like the seasons - spring, summer, autumn, and winter. Just as nature shifts from one season to another, financial markets go through different stages.

Spring is all about growth, summer is the peak, autumn is when things decline, and winter is a time to recharge and relax. This comparison to nature helps us grasp how market activity goes through ups and downs.

Market Cycle

Let's dive deeper into each phase of the market cycle and explore the indicators that accompany them.

Expansion Phase

During the expansion phase, it's like the economy is in full bloom - kind of like how things pick up in spring. People are feeling good about the economy, so they're spending more and investing in new opportunities. Businesses are doing well, and they're growing to keep up with the demand. You'll also see more companies going public because they want to take advantage of the good market conditions.

Signs that the economy is in expansion mode include higher retail sales, a busy housing market, and increased industrial activity. All these indicators show that the economy is doing great and is set to keep on growing.

Peak Phase

When the market is booming and everyone is feeling positive, some experienced traders start getting a bit cautious. It's like when summer is at its hottest - there's a lot going on, and the markets are bustling with activity. People are spending a lot, so stores are overflowing with goods and services. Interest rates go up because everyone wants to borrow money. The smart investors begin to review their investments, moving towards safer options to protect themselves from potential risks. While the peak phase shows the economy at its best, it also hints at an upcoming slowdown.

A market peak can be identified by several signs: widespread consumer spending, stores having more inventory than sales, and the rising cost of borrowing money. These indicators suggest that the market has reached its zenith.

Contraction Phase

In a down phase, the economy slows down as important economic signs start to fall. It's like the autumn time - when the bright colors of summer disappear and nature gets ready for a break. Wages stay the same, joblessness goes up, and people spend less as their trust dwindles. The market gets more unstable as investors get ready for uncertain times.

To stay safe, traders play it defensive by protecting their money instead of looking for big growth chances. Businesses face tough times as they deal with lower demand and stricter credit terms. But it's also a period of change, where issues are fixed, laying the groundwork for future growth.

Trough Phase

During the trough phase, the market hits rock bottom with low investor confidence and a lot of negativity. It's like the depths of winter - everything seems gloomy, but there's hope of a turnaround. Prices of assets are down, making it a great time for smart investors to find good deals. Even though things seem gloomy, sharp traders can see the chance for long-term profits and position themselves well. Alongside the pessimism, we start seeing hints of economic recovery as businesses adjust to the market's changes. Job cuts begin to level off, and consumers start feeling more positive, setting the stage for the next upswing.

Understanding market cycles and their accompanying indicators is essential for navigating the complexities of the financial markets. By recognising the patterns inherent in market cycles, investors can anticipate trends and make informed decisions that align with their investment objectives.

As you start investing, keep an eye out, stay updated, and be ready to adjust to market changes. Knowing how markets work will help you confidently handle their fluctuations.