Nasdaq, Russell 2000, & MSCI World Index Explained Key Market Indexes

Key Takeaways

In this comprehensive lesson, we are going to discuss three fundamental stock market indexes:

The NASDAQ Composite

Let's talk more about the NASDAQ Composite. It was set up back in 1971 and is one of the most widely watched stock market indexes globally. This index follows how well over 3,000 companies listed on the NASDAQ stock exchange are doing.

The NASDAQ is famous for having lots of tech and internet-based companies. Big names like Apple, Amazon, and Google (Alphabet) are part of this index, which helps us understand how the technology sector is performing.

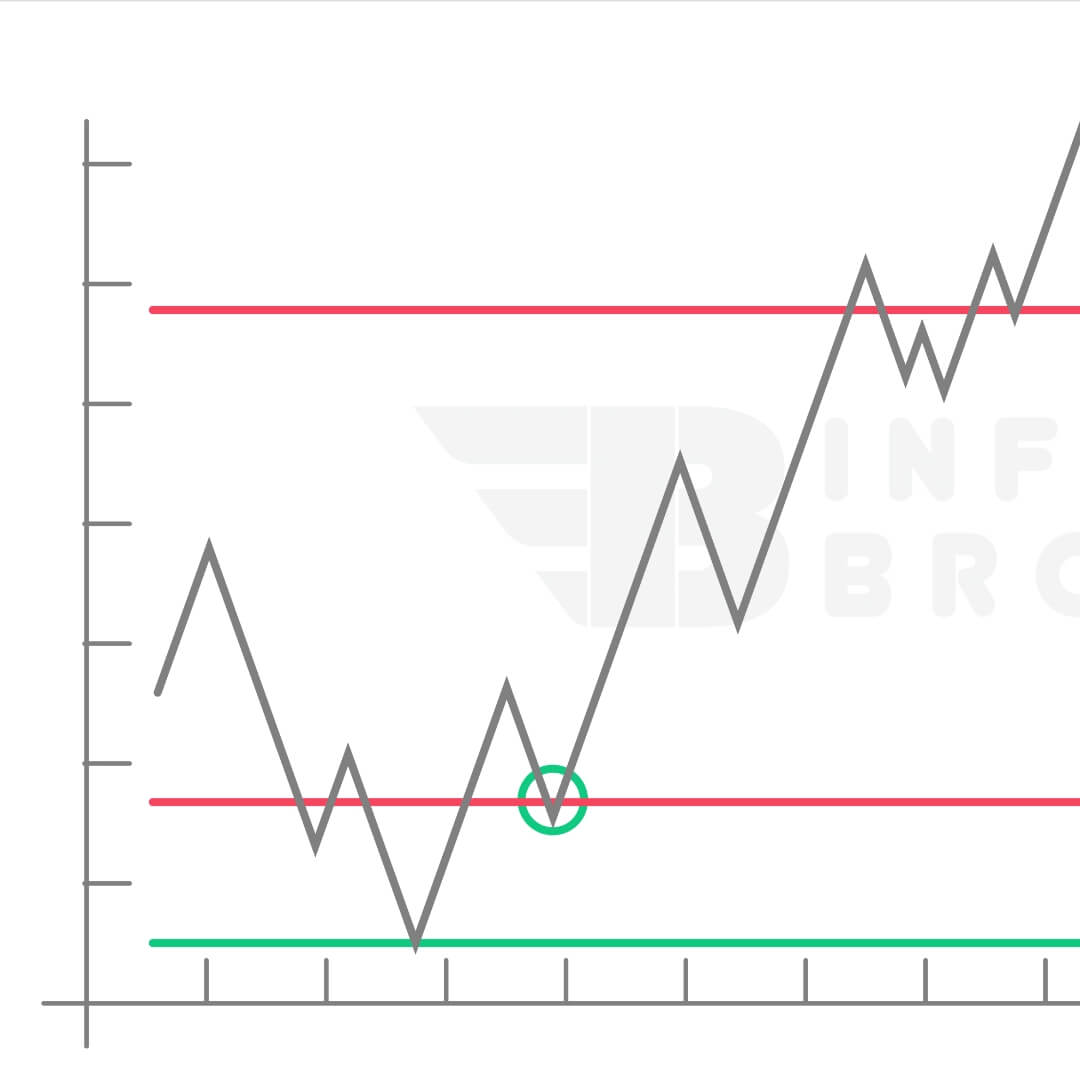

Keeping an eye on the NASDAQ Composite lets investors see how well the tech-focused part of the U.S. stock market is doing overall. If the NASDAQ is going up, it shows that investors are feeling good about technology and innovation sectors. This could mean there are chances for growth and investment in these areas.

The Russell 2000

Let's talk about the Russell 2000 for a moment. Created back in 1984, this index focuses on small-cap stocks. Unlike the NASDAQ Composite, which includes big tech giants, the Russell 2000 keeps an eye on 2,000 of the tiniest publicly traded companies in the Russell 3000 Index. This broad mix of small-cap stocks gives us a good idea of how smaller, often fast-growing companies are doing.

The Russell 2000 covers a wide array of industries, ranging from biotech and manufacturing to retail and financial services. This variety shows off the creative and innovative side of the U.S. economy. Companies listed in the Russell 2000 usually have strong potential for growth but also carry higher risks.

When the Russell 2000 swings up and down, it can show us how investors are feeling about smaller companies and what's happening in the economy that affects them. A drop in the index might mean challenges for small-cap stocks, raising concerns about how well they're doing. On the flip side, if the Russell 2000 is on the rise, it could be a sign of positivity and potential opportunities for investors looking at smaller companies.

The MSCI World Index

Now, let's explore the MSCI World Index. Introduced in 1969, the MSCI World Index measures the performance of large and mid-cap stocks across 23 developed countries, including the United States, Canada, Japan, and various European nations. Unlike the NASDAQ Composite and the Russell 2000, which focus on U.S. companies, the MSCI World Index provides a global perspective on stock market performance.

The MSCI World Index includes a diverse range of industries and sectors, offering a comprehensive view of the global economy. Companies listed in this index undergo rigorous selection criteria, ensuring they represent the overall market across different regions.

When the MSCI World Index experiences fluctuations, it can signal shifts in global investor sentiment and economic conditions. A decline in the index may indicate challenges facing the global economy, while an upward trend may signal optimism and potential opportunities for international investors.

These major stock market indexes, the NASDAQ Composite, Russell 2000, and MSCI World Index—serve as essential tools for investors to assess market trends, manage risk, and make informed decisions. By understanding how these indexes function and interpreting their movements, investors can navigate the dynamic landscape of the financial markets with confidence.