Global Events & Their Impact on the Stock Market How World Events Shake the Stock Market

Key Takeaways

Understanding the Impact of Global Events on Stock Markets.

In this tutorial, we will explore how significant world events, such as health crises and wars, can influence stock markets and, in turn, affect your investments. By understanding these dynamics, you can make more informed decisions about your investments. Recognising how events affect investor behaviour is crucial for navigating the complexities of the market.

Stock markets are highly sensitive to news. Major global events often trigger reactions from investors, leading them to either buy or sell stocks, which causes market prices to fluctuate. When significant news breaks, such as a pandemic or an economic crisis, it can either frighten investors or boost their confidence, thereby affecting stock prices. Investors respond quickly to such news, trying to anticipate its impact on various industries and companies.

In this lesson, we will examine how the COVID-19 pandemic impacted the global stock market, providing a clear example of these principles in action.

The Shock of COVID-19

The COVID-19 pandemic really shook up the global economy. Lockdowns and health worries completely changed how people shop and spend, impacting businesses in different ways.

To give you an example, travel companies really struggled while tech giants like Zoom and Amazon did great, with their stock prices rising fast. The pandemic basically flipped our lives and work upside down all of a sudden, creating a huge demand for some services while others took a nosedive.

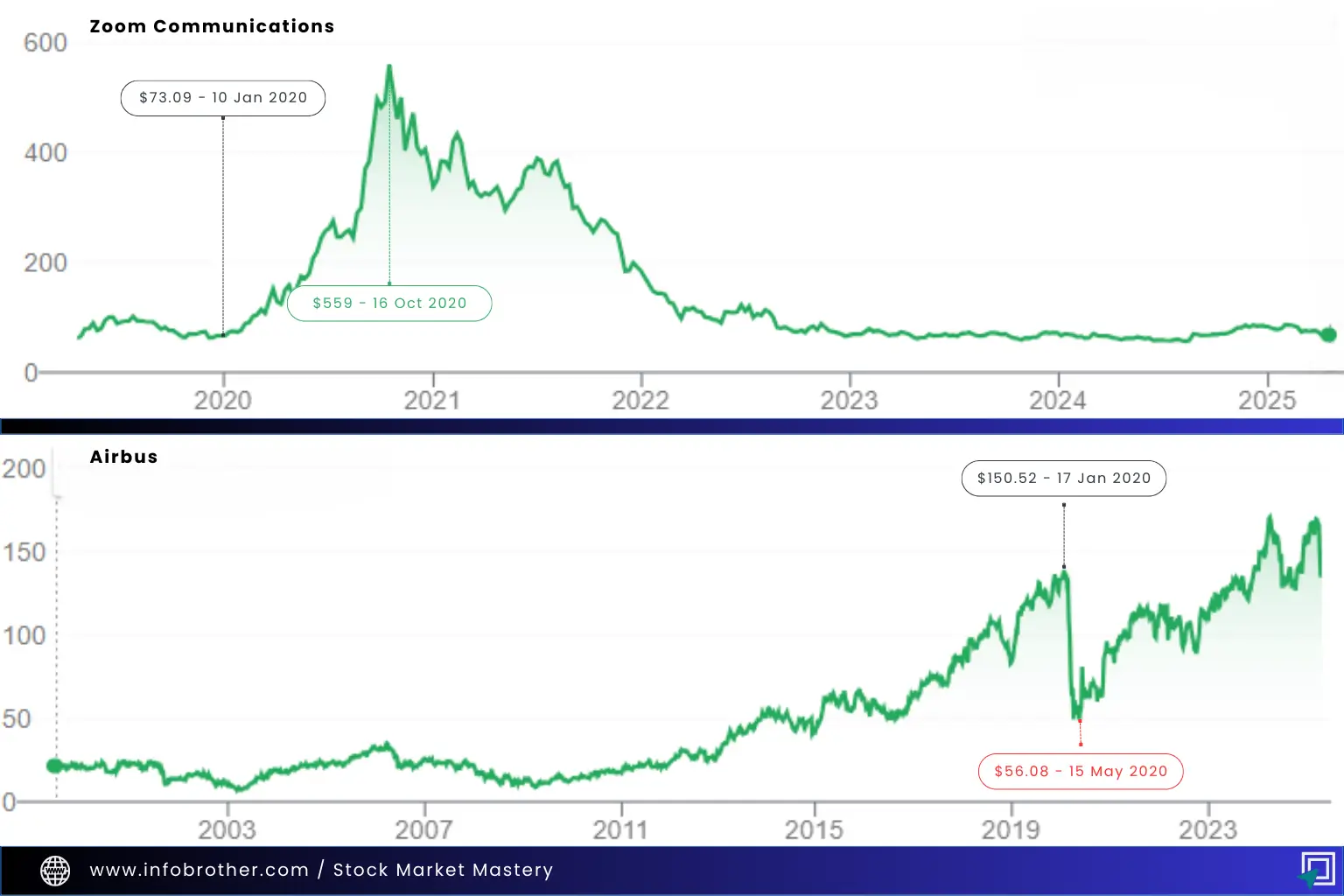

Due to lockdowns, many people turned to online communication for school, work meetings, and social interactions. This sudden shift in behaviour had a massive impact on the companies providing these services. In January 2020, as the pandemic began to unfold, Zoom's stock was priced at $73. By October 2020, it had reached a peak of $559, illustrating how the company's value skyrocketed as its services became essential.

While Zoom was flourishing, Airbus was facing some tough times. Due to travel restrictions, fewer people were flying, which meant less demand for airplanes. In January 2020, Airbus stocks were worth around $150. But by May 2020, the price had fallen to $56.08, showing a significant drop while Zoom's stock was booming. This comparison highlights how different industries can be affected in diverse ways by one major global event.

During the COVID-19 pandemic, how people spent their money changed a lot because of lockdowns and health worries. These changes didn't impact all businesses the same way.

For instance, there was a big increase in the need for remote work tools and online shopping, which was good news for tech and internet retail companies. Since everyone was mostly at home, they ended up spending more on entertainment, shopping online, and apps for chatting.

This change in how people were spending their money opened up chances for businesses that were able to adjust fast to the new situation. Investors who could see these shifts coming and put their money into the right sectors early on often made a lot of money. Take Amazon for example, during this time more people were shopping online instead of going to stores, so Amazon's sales went up a lot.

Market Recovery and Resilience

As vaccines became more available and lockdowns were gradually lifted, we saw many stocks starting to bounce back, showing how tough the markets can be. With countries opening up again, it seemed like there was hope for various industries to recover. People who had a hunch about this recovery put their money into areas like travel, entertainment, and traditional stores, which saw a strong comeback after the lockdowns. This whole situation proves just how resilient the market can be when faced with tough times.

During this recovery period, Airbus stocks rebounded from $75 to $130 within a year. This shows how global events can shake things up in the stock market - some go up, some go down.

Despite the initial chaos, many stocks bounced back once things started looking up, proving how important it is for the market to be strong. People who stayed patient and informed during that time often saw their investments recover and even thrive

Staying Informed for Profitable Decisions

To make profitable investment decisions during such events, it is crucial to stay informed about global developments. Regularly following news, analysis, and reports can help you understand the potential market impact of these events. Reflecting on past global events and their effects on the market can also equip you to better predict and respond to future occurrences.

Understanding the influence of different sectors, staying informed, and being adaptable are essential strategies for navigating the stock market during global events. By practicing the analysis of news and trends, you can identify potential investment opportunities ahead of the curve and make more informed decisions.